Happy New Year everyone!

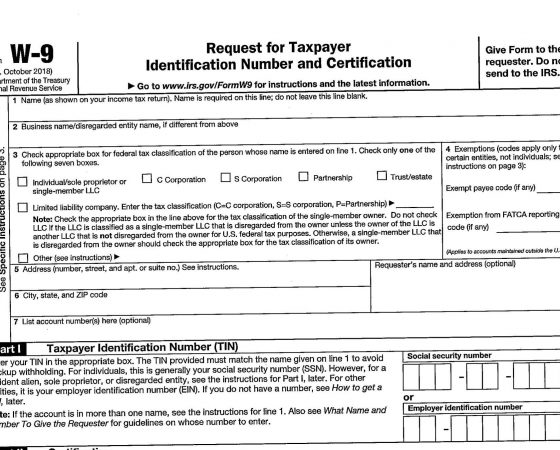

This is a message to business owners who plan to hire subcontractors for the new 2020 tax year. You as a business owner need to make sure that your subcontractors fill out a W9 form before having them complete any work in the 2020 year. A new W9 form should be filled out every year their is an information change for the subcontractor. Keeping a new W9 on file every year is important so you have up to date information on the subcontractor, such as their address. This information helps to file the required 1099 forms at the end of the tax year. In order to download or print out a W9 form please visit the IRS Website.